Trial balance is a draft report used by accountants that simply lists all the ledger account balances extracted from the accounting system of a business at a given date. Trial balance enables accountants and management of XYZ COMPANY, to take a quick glance at all the account balances at any time during the year. However, the balances usually require various adjustments before they may be used in the preparation of financial statements such as income statement, balance sheet etc.

Since the numbers in a trial balance keep updating constantly while various journal entries are posted in the accounting system, the figures in the trial balance keep changing as well and updated trial balance needs to be drawn up quite often.

Trial balance is only intended for internal use and is not meant to be presented in an annual report. This is because the presentation is overly simplistic and accounts may not even be classified properly into current and non-current assets or liabilities, equity, etc. Also, trial balance is a draft report and may need numerous corrections.

Trial balance is sometimes named according to what stage of the accounting cycle it belongs to. Such as:

- Unadjusted trial balance: before any adjusting entries are posted

- Adjusted trial balance: after adjusting entries are posted

- Post-closing trial balance: after closing entries are posted

Amounts in a trial balance against each account are usually listed in two columns i.e. debit column and credit column. Since transactions are recorded using double entry rules, the total of debit side should allways equal the total for credit side.

Most accounting work is done on computers these days which greatly simplifies the generation of trial balance by enabling accountants to instantly generate a trial balance at any point in time or even two or multiple comparative trial balances at various dates and cumulative debits and credits in each account between the two dates.

Example

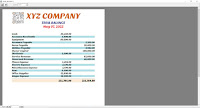

The following example shows a simple trial balance. This example is same as the one we produced from the ledgers of XYZ COMPANY.

| XYZ COMPANY |

||

|---|---|---|

| Trial Balance | ||

| October 12, 2020 | ||

| Debit | Credit | |

| Cash | $56,430 | |

| Accounts Receivable | 5,900 | |

| Office Supplies | 22,800 | |

| Prepaid Rent | 36,000 | |

| Equipment | 80,000 | |

| Accounts Payable | $5,200 | |

| Notes Payable | 20,000 | |

| Utilities Payable | 3,964 | |

| Unearned Revenue | 40,000 | |

| Common Stock | 100,000 | |

| Service Revenue | 82,600 | |

| Wages Expense | 38,200 | |

| Miscellaneous Expense | 3,470 | |

| Electricity Expense | 2,470 | |

| Telephone Expense | 1,494 | |

| Dividend | 5,000 | |

| Total | $251,764 | $251,764 |

Reviewed by Businesspro

on

6:27:00 PM

Rating:

Reviewed by Businesspro

on

6:27:00 PM

Rating: