Businesspro entries Example

Company A was incorporated on January 1, 20X0 with an initial capital

of 5,000 shares of common stock having $20 par value. During the first

month of its operations, the company engaged in the following

transactions:

| Date | Transaction |

|---|

| Jan 2 | An amount of $6,000 was paid as Rent for three months. |

| Jan 3 | Paid $60,000 cash on the purchase of equipment

costing $80,000. The remaining amount was recognized as a one year note

payable with an interest rate of 9%. |

| Jan 4 | Purchased office supplies costing $17,600 on account. |

| Jan 13 | Provided services to its customers and received $28,500 in cash. |

| Jan 13 | Paid the accounts payable on the office supplies purchased on January 4. |

| Jan 14 | Paid wages to its employees for the first two weeks of January, aggregating $19,100. |

| Jan 18 | Provided $54,100 worth of services to its customers. They paid $32,900 and promised to pay the remaining amount. |

| Jan 23 | Received $15,300 from customers for the services provided on January 18. |

| Jan 25 | Received $40,000 as an advance payment from customers. |

| Jan 26 | Purchased office supplies costing $5,200 on account. |

| Jan 28 | Paid wages to its employees for the third and fourth week of January: $19,100. |

| Jan 31 | Paid $5,000 as dividends. |

| Jan 31 | Received an electricity bill of $2,470. |

| Jan 31 | Received a telephone bill of $1,494. |

| Jan 31 | Miscellaneous expenses paid during the month totaled $3,470 |

The following table shows the journal entries for the above transactions.

| Date | Account | Debit | Credit |

|---|

| Jan 1 | Cash | 100,000 | |

| | Common Stock | | 100,000 |

| Jan 2 | Rent | 6,000 | |

| | Cash | | 6,000 |

| Jan 3 | Equipment | 80,000 | |

| | Cash | | 60,000 |

| | Notes Payable | | 20,000 |

| Jan 4 | Office Supplies | 17,600 | |

| | Accounts Payable | | 17,600 |

| Jan 13 | Cash | 28,500 | |

| | Service Revenue | | 28,500 |

| Jan 13 | Accounts Payable | 17,600 | |

| | Cash | | 17,600 |

| Jan 14 | Wages Expense | 19,100 | |

| | Cash | | 19,100 |

| Jan 18 | Cash | 32,900 | |

| | Accounts Receivable | 21,200 | |

| | Service Revenue | | 54,100 |

| Jan 23 | Cash | 15,300 | |

| | Accounts Receivable | | 15,300 |

| Jan 25 | Cash | 40,000 | |

| | Unearned Revenue | | 40,000 |

| Jan 26 | Office Supplies | 5,200 | |

| | Accounts Payable | | 5,200 |

| Jan 28 | Wages Expense | 19,100 | |

| | Cash | | 19,100 |

| Jan 31 | Dividends | 5,000 | |

| | Cash | | 5,000 |

| Jan 31 | Electricity Expense | 2,470 | |

| | Utilities Payable | | 2,470 |

| Jan 31 | Telephone Expense | 1,494 | |

| | Utilities Payable | | 1,494 |

| Jan 31 | Miscellaneous Expense | 3,470 | |

| | Cash | | 3,470 |

The second step of accounting cycle is to post the journal entries to the ledger accounts.

The journal entries

recorded during the first step provide information about which accounts

are to be debited and which to be credited and also the magnitude of

the debit or credit see debit-credit-rules.

The debit and credit values of journal entries are transferred to

ledger accounts one by one in such a way that debit amount of a journal

entry is transferred to the debit side of the relevant ledger account

and the credit amount is transferred to the credit side of the relevant

ledger account.

After posting all the journal entries, the balance of each account is

calculated. The balance of an asset, expense, contra-liability and

contra-equity account is calculated by subtracting the sum of its credit

side from the sum of its debit side. The balance of a liability, equity

and contra-asset account is calculated the opposite way i.e. by

subtracting the sum of its debit side from the sum of its credit side.

Example

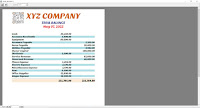

The ledger accounts shown below are derived from the journal entries of XYZ COMPANY.

Asset Accounts

| Cash | | Accounts Receivable |

| $100,000 | $6,000 | | $21,200 | $15,300 |

| 28,500 | 60,000 | | | |

| 32,900 | 17,600 | | | |

| 15,300 | 19,100 | | | |

| 40,000 | 19,100 | | | |

| | 5,000 | | | |

| | 3,470 | | | |

| $86,430 | | | $5,900 | |

| Office Supplies | | Rent |

| $17,600 | | | $6,000 | |

| 5,200 | | | | |

| $22,800 | | | $36,000 | |

| Equipment |

| $80,000 | |

| $80,000 | |

Liability Accounts

| Accounts Payable | | Notes Payable |

| $17,600 | $17,600 | | | $20,000 |

| | 5,200 | | | |

| | $5,200 | | | $20,000 |

| Utilities Payable | | Unearned Revenue |

| | $2,470 | | | $40,000 |

| | 1,494 | | | |

| | $3,964 | | | $40,000 |

Equity Accounts

| Common Stock |

| | $100,000 |

| | $100,000 |

Revenue, Dividend and Expense Accounts

| Service Revenue | | Dividend |

| | $28,500 | | $5,000 | |

| | 54,100 | | | |

| | $82,600 | | $5,000 | |

| Wages Expense | | Miscellaneous Expense |

| $19,100 | | | $3,470 | |

| 19,100 | | | | |

| $38,200 | | | $3,470 | |

| Electricity Expense | | Telephone Expense |

| $2,470 | | | $1,494 | |

| $2,470 | | | $1,494 | |

The ledger accounts step of accounting cycle completes here. The next step is the preparation of unadjusted trial balance.